Daisy

Daisy Adopted November 2025 (PA/DE) Daisy came into rescue in October when her family found that as a puppy she

It takes a village is something we always say. There are so many people to thank, from the intake coordinators, phone interviewers, transports road warriors, home check volunteers and so many more. We also want to thank all those who help to support the process with your generous donations.

Daisy Adopted November 2025 (PA/DE) Daisy came into rescue in October when her family found that as a puppy she

Henry Adopted November 2025 (VA) Meet Henry! Henry is one of the sweetest Great Danes you’ll ever meet — a

Scooby-Dee Adopted November 2025 (WV) Congratulations the Crowley’s on Adopting Scooby Dee! We’re overjoyed to share that Scooby Dee has

Zeus Adopted November 2025 (WV) Congratulations the Kasey and family on Adopting Zeus! We are thrilled to share the wonderful

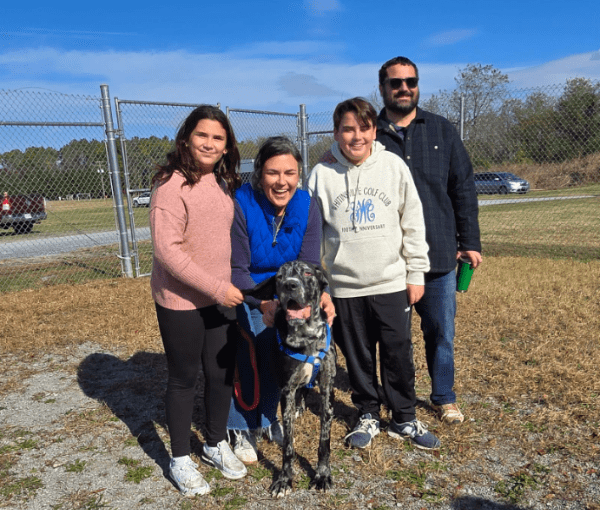

Rocky Adopted November 2025 Rocky is a 2 year old male merle Dane with natural ears. He is a sweet

Sadie Adopted November 2025 Sadie is a gorgeous 2 year old brindle female with natural ears. Sadie is a gentle

Huxley Adopted in November 2025 (NJ) Huxley was adopted by repeat adopters who lost their Dane earlier this year. He

Dixie Adopted November 2025 (NJ) Dixie was adopted by her foster family and will live out her golden years being

Merida and Fiona Adopted as a Courtesy Listing February 2026 Location: Syracuse, NY Children: good with all Dogs: good with

Adopted February 2026. Adopted February 2026. 3 year old Neutered Male who is healthy, happy and very very sweet. Good

Faith Adopted January 2026 (NJ) Faith was adopted by NJ a family with 2 human daughters and a canine sibling.

Noel Adopted January 2026 (VA) Location: Berryville, VA Children: Unknown Dogs: Not good with other dogs Cats: Good with cats